Tuesday, 19 February 2013

Datamonitorenergy.com is now live!

Datamonitor Energy group has now launched a dedicated website, replacing this blog account.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

British Gas suffers PR disaster at the hands of Stephen Fry in front of 5 million Twitter users

British Gas utilizes a multi-million pound marketing budget to advertise to potential customers and reassure existing customers that its service functions are effective, with the customer the center of attention. However, when a well-followed celebrity decides to air his complaints on Twitter, that marketing message can quickly be lost.

On February 15, 2013 a clearly disgruntled Stephen Fry decided to tweet the fact that British Gas was "threatening to send in bailiffs" for a bill that he claimed he had already paid. Although customer forums on sites such as Moneysupermarket.com are frequently unearthing instances such as this, none have the reach that Fry can generate through his Twitter follower base, which numbers over 5 million people.

But what does this mean for British Gas? Well, on a purely market share estimate, if any of these 5 million followers are located in the UK, over 20% of these will be British Gas customers who will now have a decidedly worse opinion of their supplier - an opinion that will be crucial when they next come to assess their energy supplier. Another factor will be that Fry's grievance seemed to be rectified relatively quickly according to his timeline, which will not be a good message if the "ordinary" customer cannot achieve the same results. Providing preferential treatment is not a welcome marketing image for a company that is already perceived as being untrustworthy and not acting in the best interests of its customer base, with its profit announcements regularly drawing sharp criticism from consumer groups over a profiteering attitude.

Source: Twitter

What is clear, however, is that Fry's problem is a common one, and not just for British Gas customers. In fact, a quick sweep of online customer forums shows that all of the Big Six are culpable of putting customers in similar positions. Due to this, smaller suppliers such as Good Energy, Ecotricity, and Ovo Energy are using the niche customer acquisition strategy of simply treating customers well to entice them away from the larger suppliers. This is reaping benefits, with smaller suppliers growing at a steady rate since entering the market.

Datamonitor's forthcoming research brief, titled: "Customer Satisfaction Strategies in the UK Domestic Market" (due early March 2013), will use firsthand customer opinion data to analyze what the smaller suppliers have done to provide outstanding service compared to the behemoths of the industry, and in what areas some suppliers have been failing to provide stellar service.

Written by Tom Haddon

Analyst, Datamonitor Energy

Follow Tom on Twitter: @TomH_DMEN

For more information visit:

Datamonitor Energy group has now launched a dedicated website, replacing this blog account.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

Ask an analyst: asken@datamonitor.com

Follow Datamonitor on Twitter: @DatamonitorEN

Thursday, 14 February 2013

UK Gas Generation Strategy fails to reassure investors

In December 2012 the UK government published its Gas Generation Strategy to provide reassurance to investors in new gas generation, of which 26 GW could be needed by 2030 and 9 GW by 2020 to replace ageing gas and nuclear capacity.

On Feb. 13th the House of Commons Energy and Climate Change Committee (ECC) heard testimony as to whether the strategy has actually provided reassurance and what the impact might be on carbon emissions. Other issues addressed included carbon capture and storage, combined heat and power, and biogas.

All those testifying (from academia, major utilities, and NGOs) agreed to some extent that the strategy was not achieving its aim - at least, not yet.

The strategy appears to investors essentially as a scenario document, in which different assumptions are made for gas use, with different carbon targets and gas prices.

In an echo of evidence sessions heard by the same committee on the question of nuclear generation in October 2012, the key word of the morning was clarity. Investment in new gas plant, as with wind generation, is long term, and will be impeded until policy goals are transparent. A common view was that speed in the government’s electricity market reform is needed to provide such clarity.

Another theme of the day was capacity. The point was strongly made that gas and renewables should not to be pitted against each other. The question is rather how gas can complement low carbon generation. A capacity mechanism that remunerates the fixed cost of new gas generation (high operating costs but low construction costs) along with renewable generation (with zero fuel cost but large fixed costs) was proposed by the second panel in particular as the best way to de-risk supply and reduce the price that end consumers pay. The launch of a capacity market for gas in 2014 is intended to be one of the main tools for change.

The committee questioned whether the support given until now to renewable generation was in fact the driving factor for adjustment in the gas market. Whether one supports this viewpoint or not, Datamonitor believes that investors considering the UK will remain somewhat in limbo until the government makes it clear – notably through the decarbonisation target to be introduced in 2016 looking ahead to 2030 – just how much renewable power capacity it intends to have.

Written by Yasmin Valji

Analyst, Datamonitor Energy Team

Follow Yasmin on Twitter: @YasminV_DMEN

For more information:

Datamonitor Energy group has now launched a dedicated website, replacing this blog account.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

Email: asken@datamonitor.com

Twitter: @DatamonitorEN

Friday, 8 February 2013

Small energy suppliers provide the best service to residential customers

According to the Which? 2013 energy companies satisfaction survey,

the best service provided to residential energy customers is from smaller

independent suppliers such as Good Energy and Ecotricity. Datamonitor Energy

will publish research analyzing the factors that prevent the Big Six heading

the table and the disparities in the satisfaction levels from smaller

suppliers.

The survey

had suppliers from outside the Big Six occupying the top eight spots, clearly

demonstrating that there are tangible differences between the strategies of

large and small suppliers. The common theme for small suppliers is their

attention to premium levels of customer service. The relatively new niche for these

suppliers is to be kind toward customers and use this as an acquisition

strategy for customers who value this over price or brand recognition.

However, not

all smaller suppliers are using this strategy; First Utility is focusing solely

on price. The growth of First Utility has surpassed that of other independent

suppliers, with turnover increasing in the thousands of percent over the last four

years. Yet this revenue growth has been to the disadvantage of its customer

service functions and processes; it was rated ninth in the table, with customer

forums full of tales from angry and frustrated customers.

The Big Six

are now trying to improve trust issues with customers to combat the competition

- for example, E.ON's "Reset Review," SSE's "Customer Charter

Guarantee," and so on. Yet a valid question for these utilities is whether

it really is a priority to dedicate much focus on customer service if they

already control 99% of the market. With millions of customers - compared to

thousands for the smaller suppliers - the Big Six tend to utilize marketing

campaigns to attract customers. Low switching rates and apathy toward switching

ensures that customer losses remain a very small fraction of the overall base.

Datamonitor's

forthcoming research brief, titled: “Customer Satisfaction in the UK Domestic

Market” (due early March 2013) will use first hand customer opinion data to

analyze how most of the smaller suppliers have provided outstanding service

compared to the behemoths of the industry, and in what areas the lower ranked

suppliers have been faltering.

Written by Tom Haddon

Analyst, Datamonitor Energy.

Follow Tom on Twitter: @TomH_DMEN

For more information:

Datamonitor Energy group has now launched a dedicated website, replacing this blog account.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

Email: asken@datamonitor.com

Twitter: @DatamonitorEN

Wednesday, 6 February 2013

Cost overruns and prolonged uncertainty dissuade Centrica from UK nuclear investment

Centrica has withdrawn from

its nuclear rebuilding partnership with EDF in the UK, citing rising costs,

delays, and regulatory uncertainty. The utility must now decide where and on

what to focus its resources, with potential opportunities arising in gas and

offshore wind.

Email: asken@datamonitor.com

Centrica has withdrawn its 20% stake in

its partnership with EDF to build new nuclear capacity in the UK. Four new EPR

reactors are planned at Sizewell C (Suffolk) and Hinkley Point C (Somerset).

Centrica acquired the option in 2009, along with a 20% share in the eight

nuclear plants currently operated by EDF, which Centrica will retain. At that

time Centrica raised GBP2.2bn in additional capital to finance the options, of

which it will launch GBP500m in share repurchases to return capital to

shareholders in 2013.

Centrica's decision comes as no surprise,

and EDF has been looking for new partners since September 2012. EDF's most

advanced discussions are with China Guangdong Nuclear Power Group (CGNPC), with

which it is already working to build two new EPR reactors in Taishan, China.

Chinese capital could assist EDF at a time

when it lacks sufficient capital to see its investments in the UK to fruition

alone. However, no confirmation from CGNPC is likely before any concrete

figures come out of the discussions between EDF and the UK government on

Contracts for Difference (CfD) feed-in tariffs, which were most recently

rumored to be around GBP100/MWh.

The rising costs and longer-than-expected

construction times weighed heavily on Centrica's decision. It is less clear,

however, whether the potential revenue flows, primarily determined by the level

of the CfDs, were a critical factor.

Centrica now needs to decide where it will

reposition its resources, and swiftly. It has already written off GBP200m in

predevelopment costs in 2012, and will likely prioritize investments with

shorter development times such as offshore wind. This is likely to fare just as

well as nuclear under the new Electricity Market Reform, with the added benefit

of requiring a smaller upfront stake. Although the excess capital will be

returned to shareholders, the decision to write off the nuclear stake will

leave Centrica with more breathing room to evaluate alternative opportunities,

such as gas projects, expansion in the US market, or an acquisition of the

Irish government-owned retailer Bord Gais Energy.

Written by Yasmin Valji

Analyst, Datamonitor Energy Team

Follow Yasmin on Twitter: @YasminV_DMEN

For more information:

Datamonitor Energy group has now launched a dedicated website, replacing this blog account.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

Email: asken@datamonitor.com

Twitter: @DatamonitorEN

Monday, 4 February 2013

SME customers struggle to see the benefit of smart meter installation

Datamonitor's Energy

Buyer Research survey has found that businesses of different sizes are

assessing the benefits of the smart meter roll out very differently.

Email: asken@datamonitor.com

During H1 2012 Datamonitor conducted in-depth interviews with

energy buyers at businesses of all sizes to determine the satisfaction of the

customer experience throughout the smart meter installation process and to

assess the benefits seen since installation.

Large power consumers responded with positive comments 57% of the

time when asked about the benefits they have experienced after the installation

of smart metering, while smaller consumers only gave positive comments 20% of

the time.

The graph below shows how SME and MEU customers have responded to

smart meters since installation was completed. Respondents provided positive

comments (highlighting only benefits), mixed comments (no change in experience

or seeing benefits and problems), or negative comments (highlighting only

problems). SMEs' experience post-installation is still not conclusive, with

mixed comments forming the majority. Although many feel that the units have not

been installed long enough to judge, there is certainly an element of not being

used to the technology and lacking full understanding. Technical problems,

while rare, appeared to be catastrophic, with one SME reporting that its new

meter "hasn't given meter readings as it can't get a signal."

Source: Datamonitor

MEU customers have a much more favorable view of smart meters,

with 57% of MEU comments positive toward the technology. This statistic is

higher due to these customers being more aware of usage before installation and

being able to interact with the technology more effectively.

Datamonitor also asked respondents to assess any cost savings.

SMEs are much more likely not to see a change in costs due to a lack of

pre-installation information on usage and costs. Power MEUs, which are more

reliable in judging cost savings due to better pre-installation information,

averaged less than 5% cost savings, which is in line with domestic trials of

the technology (circa 3% as reported in Ofgem's Energy Demand Research Project:

Final Analysis, June 23, 2011).

The research found that during the installation process, SMEs

spending less than GBP50,000 a year on power were much more likely to enjoy a

problem-free experience. 89% of SMEs reported no problems with installation,

while only 63% of MEUs spending more than GBP50,000 per year on power said

this. This is due to 22% of MEU power customers reporting that energy supply

was disrupted during the installation.

More detail is available in Datamonitor's B2B Smart Meter Roll Out:

Analysis of Customer Experiences (January 2013, EN00009-019).

Written by Tom Haddon

Analyst, Datamonitor Energy

Follow Tom on Twitter: @TomH_DMEN

For more information:

Datamonitor Energy group has now launched a dedicated website, replacing this blog account.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

Email: asken@datamonitor.com

Twitter: @DatamonitorEN

Major French electricity users unhappy at cost disadvantage compared to Germany

French large energy users are lobbying the government to restructure electricity tariffs. Comparisons with Germany appear to reveal large disparities, placing French industry at a disadvantage; however, no action has yet been taken by the French regulator to address these concerns.

French retail customers enjoy some of Europe's lowest electricity prices, which stood at 0.142kWh (taxes included) in November 2012. This is due to the country's large nuclear industry. However, major industrial electricity users do not see the same benefits, and some may be extremely vulnerable to changes in price. ArcelorMittal, for example, uses 1% of France's electricity, and for other businesses in the aluminum industry electricity can account for up to 70% of costs.

In contrast, major industrial sites in Germany are largely exempt from distribution tariffs and pay roughly 80% of that for similar sites in France. Further, they are insulated from price rises due to carbon taxes, and they also receive relatively higher payments in exchange for voluntary cuts in supply. A large German user pays between EUR35.20 and EUR37.05 per MWh compared with EUR46.90 in France according to Uniden, the French union of large energy users.

The subsidies granted by the German government recognize the impact on competitiveness of the cost of electricity, and that large industry is geographically mobile. The government has already implemented a set of measures to spare major energy users the electricity price increases that the German public faces due to the replacement of nuclear generation by renewable energy.

In France Uniden has demanded that the government give large industrial users similar cost advantages. This topic was discussed recently in a seminar organized by the Union for a Popular Movement backbencher Francois-Michel Gonnot. The seminar brought together key representatives from regulatory bodies and utilities and focused on the costs and financing of the energy transition in France.

The minister of ecology Delphine Batho spoke at the seminar, and while recognizing the measures taken to protect German industry underlined the fact that their SMEs carried high costs. No concrete response to Uniden's lobbying is expected from the French energy regulator before October 2013, when the government will begin drawing up a new law on France’s energy transition.

In times of fiscal austerity, Datamonitor expects the weight of Uniden to pale in comparison to that of France's small energy consumers; the government has already agreed to reimburse EDF EUR4.9bn out to 2018 for various costs incurred under the CSPE charge (including the extra cost incurred for buying solar and wind generation at guaranteed state rates).To avoid substantive electricity price increases, the government can be expected to prioritize subsidies to small consumers for political reasons, and may encourage large energy users to manage their energy procurement more effectively.

Written by Yasmin Valji

Analyst, Datamonitor Energy

Follow Yasmin on Twitter: @YasminV_DMEN

For more information:

Datamonitor Energy group has now launched a dedicated website, replacing this blog account.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

Email: asken@datamonitor.com

Twitter: @DatamonitorEN

Wednesday, 30 January 2013

EDF and Areva target nuclear reactor sales in Saudi Arabia

French

utilities EDF and Areva are poised to enter the nascent Saudi Arabian nuclear

market, but face competition from South Korean, Japanese, and Russian bidders.

Saudi Arabia is one of the world's biggest oil producers, with

only Russia and the US coming close. However, domestic oil demand is rising at

a rate of 8% per annum and unless oil production growth can keep pace - which

is unlikely - volumes of oil available for export will diminish.

Saudi Arabia intends therefore to diversify its energy mix towards

renewables and nuclear. In May 2012, plans were announced to construct 16

nuclear power reactors with 17GW of capacity by 2032, at a cost of $80bn. In

addition, 16GW of solar PV capacity, 25GW of solar CSP capacity, and 4GW of

bioenergy and geothermal capacity are planned by 2030.

Although Saudia Arabia has not issued a tender for nuclear power

projects, the French government has already expressed interest. In early 2011,

EDF and Areva opened a joint office in Riyadh, offering technological knowhow

and training to local staff.

However, France faces stiff competition from other potential

bidders, including a South Korean consortium led by Korea Electric Power

Corporation, a Japanese consortium led by the International Nuclear Energy

Development of Japan Co, and Russia's Rosatom.

In France's favor is Areva's expertise in the entire nuclear

value-chain, and EDF's experience in building and operating nuclear plants.

Against it are Areva's cost overruns and project delays in the Flamanville

(France) and Olkiluto 3 (Finland) plants. Areva's previous attempt to enter the

Middle Eastern market failed when it lost a $40bn contract to build and operate

four nuclear reactors in the UAE in 2009.

The move into Saudi Arabia fits EDF's and Areva's strategy to

pursue contracts outside Europe following the French government's intention to

reduce nuclear power's share of the generation mix by 25% by 2025.

Areva and EDF's relationship has been a troubled one; however, the

two have managed to work together since February 2011 to lead France's nuclear

export drive. The fruits of this agreement can be seen in EDF's partnership

with China Guangdong Nuclear Power Holding Co to build two EPR reactors in

Taishan, southern Guangdong, for which Areva is providing the reactors. Datamonitor

expects that their long-term partnership will optimize France's chances of

building on its success in China and in winning further major contracts such as

that targeted in Saudi Arabia.

Written by Yasmin Valji

Analyst, Datamonitor Energy

email: yvalji@datamonitor.com

Follow Yasmin on Twitter: @YasminV_DMEN

Email: asken@datamonitor.com

For more information:

Datamonitor Energy group has now launched a dedicated website, replacing this blog account.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

Email: asken@datamonitor.com

Twitter: @DatamonitorEN

Monday, 28 January 2013

Calls for action as networks struggle with German energy revolution

Support is

growing for the German federal government to take a greater role in pending

grid development projects that will increase the connectivity of scattered

renewable sources, with calls even for part-privatization.

The growing pace of the German Energiewende is highlighted by the

fact that the share of renewable electricity generation in Germany rose to 26%

in the first half of 2012, primarily from solar and wind capacity.

Yet Germany is already facing network stability issues resulting

from sudden increases in electricity generation from renewable sources. The

fluctuations in generation on the grid can affect the production of major

industries such as coal mines and aluminum process units, forcing them to

install backup power supplies in the interests of uninterrupted production.

The German Energy Agency estimates that up to EUR42.5bn is

required in infrastructure investment by 2030 to support the country's

transition from nuclear to renewable generation, including major projects to

connect its renewable sources of electricity generation to demand centers in

the south.

This marks Germany as a potential market for grid investments by

both domestic and foreign players: for example in January 2013, Japan's

industrial conglomerate Mitsubishi partnered with German-Dutch grid operator

TenneT to announce the construction of four underwater connections for German

offshore wind farms in the North Sea.

Yet other grid investment is lacking. The fragmentation of the

transmission industry along with the recent network divestments made by the

large German utilities has placed management of the nation's transmission

assets in the hands of investors with little interest in co-ordinated network

development projects. Proponents of federal involvement hope that this will guarantee

that these projects proceed in the national interest.

Datamonitor sees calls for part-privatization as a step too far,

and recommends instead the shared ownership of the transmission planning

function, with federal and state governments, transmission companies, and

renewable project developers holding shares in a network development agency. A

successful example of an organization with this ownership model is the

Australian Energy Market Operator, which among other roles has responsibility

for co-ordinating transmission network development across five states.

The scope of such a transmission planning entity could grow

organically, commencing with the development of the three key lines required to

connect offshore wind projects. The question of asset ownership could be left

open, avoiding an upfront commitment by German taxpayers, but allowing for the

possibility of future government investment as an absolute last resort.

The challenge, as always, will be balancing competing development

interests and delivering renewable power to high-demand centers, while avoiding

excessive costs for German consumers.

Written by:

Rhys Kealley

Lead Analyst, Datamonitor Energy

email: rkealley@datamonitor.com

Follow Rhys on Twitter: @RhysKealley

If you have any comments or questions on the above article, please leave a comment below and the author will get back to you as soon as possible. Alternatively, contact Rhys directly using the details above.

Thursday, 24 January 2013

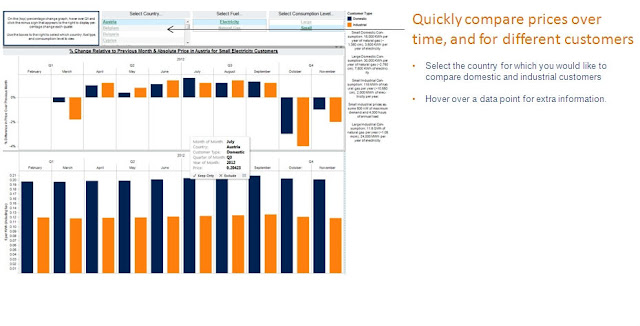

Datamonitor launches fully interactive energy retail price dashboards

Datamonitor's Retail Energy Pricing Dashboard contains retail gas and power prices in the B2C and B2B sectors across the EU. The interactive nature of the data visualization allows the user to drill down into each country's individual pricing trends.

Updated monthly, the dashboard presents data for 27 countries to provide a comprehensive European retail energy price analysis tool. Time series data going back to February 2012 is available which allows the user to identify historical trends in pricing. Data can be customized using several filters including:

• Month

• Fuel (electricity, natural gas)

• Customer type (domestic, industrial)

• Consumption level (small/large domestic, small/large industrial)

The customization can be performed with ease using single click menus for instant and insightful data analysis. The dashboards present comparisons between countries but also drill down to analyze percentage change for individual countries each month to show the real underlying price trends.

Once you have selected the data you want to view, it can be easily exported as raw data into a Microsoft Excel spreadsheet or graphs can be captured as an image, for insertion into presentations.

The images below show the introduction and time series data dashboards which are just two of the five published by Datamonitor.

Written by:

Tom Haddon

Analyst, Datamonitor Energy

email: thaddon@Datamonitor.com

Twitter: @TomH_DMEN

For more information:

Datamonitor Energy group has now launched a dedicated website, replacing this blog account.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

The new site contains more commentary, insight, and analysis from all of the Datamonitor Energy team, as well as overviews of all published and soon to publish data and research.

For more information, you can find the site here: www.datamonitorenergy.com

This blog account will close at the end of February; all future blog posts will be available from the link above.

Email: asken@datamonitor.com

Twitter: @DatamonitorEN

Tuesday, 22 January 2013

France's offshore wind brings investment opportunities

The

French government has launched its second public tender for the construction of

two circa-500MW capacity offshore wind farms, with an expected total investment

of EUR3.35bn. The tender comes in the context of small but growing anti-nuclear

sentiment, as well as the need to replace aging nuclear capacity and meet its

25GW wind power target by 2020.

France currently has 6GW of wind capacity. In 2011, wind generated

11.8TWh of power and contributed to 2.1% of the country's total electricity generation.

Nuclear generation currently dominates France's electricity generation mix,

making up 75% in 2012. However, under the leadership of the current socialist

government, France aims to reduce the share of nuclear generation to 50% by

2025 and instead turn towards solar and wind energy.

France: first and second round public tender zones for offshore

wind.

Source: Ministry of Ecology, Sustainable Development and Energy. The second round tenders are in green, the first round in red.

In this context, the government has launched a fresh public tender

for two 500MW-capacity offshore wind farms in northern France, near the islands

of Noirmoutier and Yeu on the Atlantic coast. France awarded the first tender

for offshore wind farms in April 2012, which had a capacity of 2,000MW at an

investment of EUR7bn.

22 out of the current 58 reactors in France will complete their

lifespan by 2022, leaving the government with the option to either decommission

or extend their lifespans. The significant reduction in nuclear generation

desired by the government, growing anti-nuclear public sentiment in the wake of

the Fukushima disaster in Japan, and finally the high-capital costs of

refurbishment are all factors driving the decision to shut down the aging

reactors. Indeed, the Fessenheim 1 and 2 reactors located in northeastern

France with a total capacity of 1,760MW, will be shut down by 2017.

France is a predominantly nuclear-led country; however, favorable

policy and geographical conditions mean that it is becoming an increasingly

attractive destination for renewable investment. Firstly, France has one of the

strongest feed-in mechanisms in Europe promoting wind energy, especially for

offshore projects: the feed-in tariff in France for offshore wind was

EUR0.13/kWh in 2012, which has been constant since 2008. Secondly, France benefits

from long coastlines including the English Channel, the Mediterranean, and the

Atlantic, thereby allowing an average wind speed for offshore turbines of 13.5

knots.

These strategic advantages have motivated significant investments

in wind, comprising of both domestic and foreign direct investment. For example

Boralex, based in Canada, acquired the 32MW La Vallee wind power project located

in the department of Indre, France, while German Enercon has also expanded its

presence in the Picardy region in France. In 2013 France's EDF acquired 321MW

of wind capacity in partnership with GE Energy and MEAG, which is the asset

management arm of Munich Re and ERGO. Foreign investment has also extended to

the domestic supply chain, with Japanese and Danish technology giants such as

NTN and Vestas having set up extensive turbine assembly sites in France.

Written by Yasmin Valji

Analyst in Datamonitor's Energy Team

Follow Yasmin on Twitter: @YasminV_DMEN

If you have any questions or comments, please leave these in the space below. The author will respond to you as soon as possible.

Subscribe to:

Comments (Atom)